Stop Your Company's Cash

Melting Silently.

UK Companies Lose Billions of £s Annually to Inflation & Debasement.

We Help Directors Protect Surplus Cash with Bitcoin Treasury Strategy.

The Problem

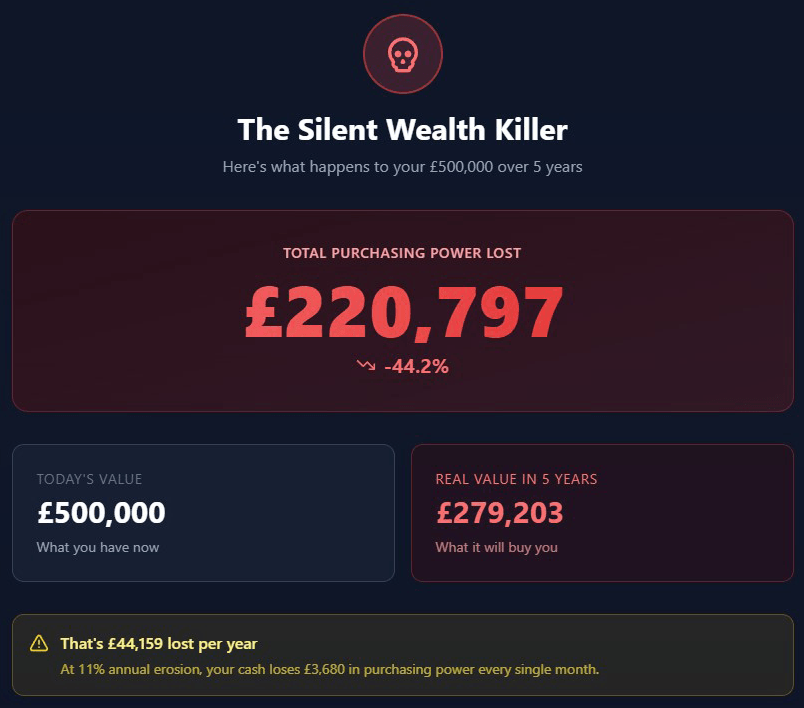

Your £500k Surplus is Losing £55k Every Single Year.

Even in "safe" high-interest accounts, you're still losing 7-8% annually after tax.

Over 5 years, that's £220k of purchasing power gone forever.

The 6-Month Bitcoin Treasury Implementation Program

Not a seminar. Not generic advice. A complete transformation.

4 Intensive Implementation Days

Live wallet setup, first purchase, policy approval

5 Months Ongoing Support

Monthly check-ins, market briefings, issue resolution

Proprietary Calculation Models

Keep forever, update anytime

8-Piece Corporate Toolkit

Policy, board resolution, accountant templates

UK-Specific Compliance Expertise

FRS 102, HMRC, accounting treatment

Why Bitcoin Treasury Advisory?

- 15 Years Bitcoin Experience — Not a 2021 entrant

- Implemented in Own UK Companies First — Not theoretical advice

- Proprietary Models & Calculators — IP you keep forever

- 6-Month Implementation Support — Not disappearing after sale

- UK-Specific Regulatory Expertise — FRS 102, HMRC, real compliance

This Program Is For UK Companies With:

- £100k+ surplus cash (non-operational, 4+ year horizon)

- Director-level decision authority

- Willingness to embrace volatility with a disciplined strategy

- Desire to protect the balance sheet from structural debasement

Not a fit?

We also offer a 2-hour workshop for companies testing the waters. Reach out and tell us you want

to book the workshop, and we’ll get you scheduled.

Your 6-Month Transformation

Month 1 — Days 1–4 (Intensive Implementation)

- Day 1: Cash erosion modelling + allocation recommendation

- Day 2: Policy approval + live wallet setup

- Day 3: First Bitcoin purchase + dashboard polish

- Day 4: Extraction strategy + long-term roadmap

Months 2–6 — Ongoing Support

Monthly 90–120 minute check-ins covering:

- Market developments & strategy adjustments

- DCA execution & portfolio review

- Issue resolution & board communication support

- Extraction timing & tax-free liquidity planning

Common Questions

Won’t my accountant block this?

That's the most common concern we hear. The good news: Bitcoin is 100% permitted for UK limited companies under FRS 102 / IAS 38 as an intangible asset. Your accountant isn't blocking it—they simply haven't seen it done before. You'll receive a ready-to-send accountant email template, plain-English accounting summary, board resolution, and sample journals. Every accountant who sees the pack says: "Oh, this is actually straightforward."

What if Bitcoin crashes right after we buy?

That's why we never rely on perfect timing. We use staged allocations, defined time horizons, treasury rules, and stress-tested scenarios. Your strategy is built on discipline and proportional exposure, not guessing the bottom.

Is this even legal for UK companies?

Yes, absolutely. Bitcoin is treated as property. Thousands of UK companies already hold it legally. The program covers legal status, accounting treatment, governance, and record-keeping, all within current UK regulations.

This sounds complicated.

That's exactly why this program exists. You don't need to become an expert. You get step-by-step implementation, security protocols, and complete templates. Most directors say afterwards: "I thought this would be 10× more complex."

About Us

- 15 years of Bitcoin experience (first purchase ~2010)

- Implemented Bitcoin treasury in own UK family companies

- Helped dozens of UK directors navigate this exact journey

- Created proprietary models used by companies managing £100M+ in Bitcoin

This isn't theory. This is what I do in my own business — taught to yours.

Ready to Protect Your Surplus?

Step 1:

Book a 15-minute discovery call

Step 2:

Review your company’s cash erosion (we’ll calculate together)

Step 3:

Decide if the 6-month program is right for you

Contact Us

Email:

Social Media:

Bitcoin Treasury Advisory Trading as F WARD LIMITED (16226501) is educational content only. This website and all materials do not constitute financial, investment, or tax advice. Always consult qualified professional advisers before making decisions.